Award-winning PDF software

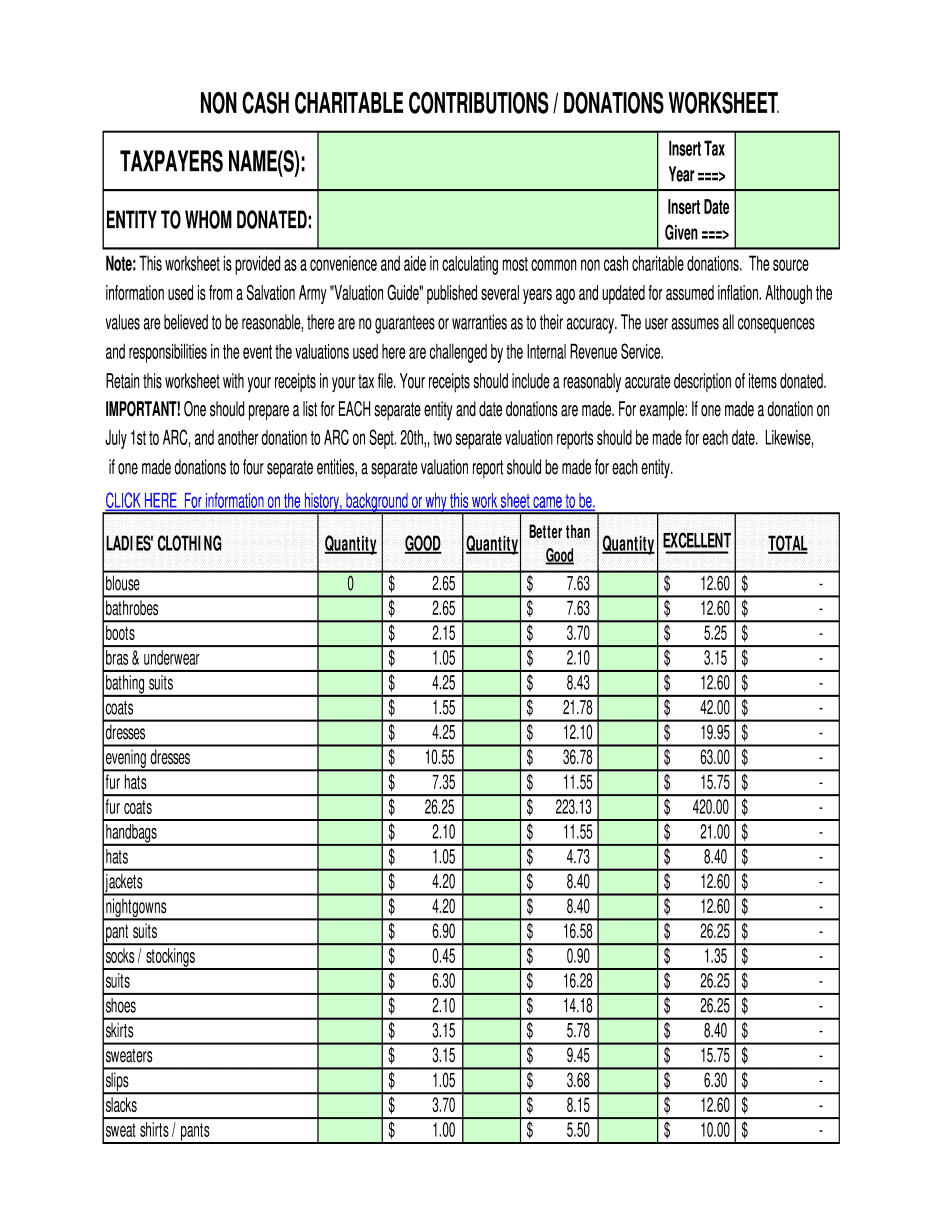

Excel donation list template Form: What You Should Know

The donation list template is ideal for large donor lists. It uses the same column and field format for donation amount, name, date of donation, type of donation, amount, or amount of gift. For a template with the same appearance but more fields, see Donor's List. Donated Gifts All other items you keep on file can be donated using the donation list template. All donations stay on file, and are available for any organization at any time. They are never destroyed or disposed of. So long as a donor's name, date of birth, and signature are on the paperwork, a donation will be good for life. Donor's Donation Form A donation form is a document you create, with information you'd like the donated stuff to say. Donor's donation form template comes in two formats: Paper For a template with the same appearance but more fields, see Donor's Form. Donation Form Organ donation forms are very similar to forms used in the donation process (e.g., donor consent form, consent form for organ replacement, consent form for an autopsy-type procedure). They're the kind of forms you can print and fill out yourself at a computer, and if the person who gave the goods is deceased, you can upload a PDF of their form if the paper donation form will be lost. Donor Consent Forms To be effective, donated items must meet the requirements necessary for an acceptable use (e.g., be usable for a useful purpose in the donor's lifetime). You have the flexibility to choose if and when to return a donor's consent form and if you'd like their signature to remain on the document. To be effective, donor consent forms have to be on file with the organ or tissue banks at least 45 days after the consent is obtained. To be effective, donor consent forms must be on file with the organ or tissue banks at least 45 days after the consent is obtained. Donor consent forms can be created online if someone has sent you the original consent form. Donor consent forms are not always available online. Donor Consent Form Organ donation consent forms will be needed, regardless of your decision. If the organ isn't suitable for transplant, a donor consent form will be needed.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Donation Value Guide Spreadsheet, steer clear of blunders along with furnish it in a timely manner:

How to complete any Donation Value Guide Spreadsheet online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Donation Value Guide Spreadsheet by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Donation Value Guide Spreadsheet from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.