Award-winning PDF software

Goodwill Valuation Guide 2025 Form: What You Should Know

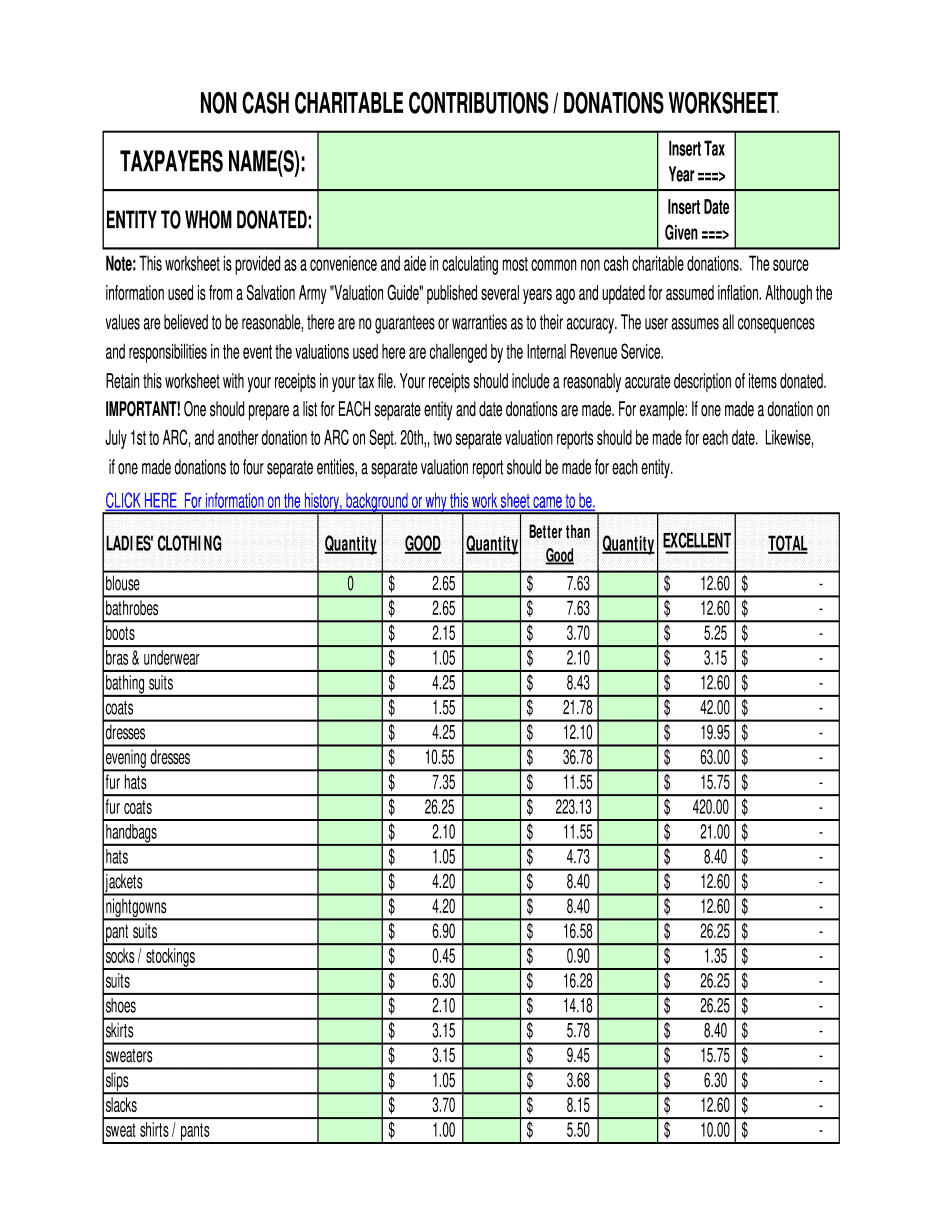

There are many important factors to consider when determining the actual fair market value of donated items. You will need to do extensive research for the item you donate. It can be helpful to use an electronic calculator such as the “Value for Tax Purposes” or “Tax Valuation Guide” (PDF). These calculators take your donation information, your state tax information, or a current and accurate list of charities and charities-related goods you could donate from the U.S. and compare that to the items on our list and determine the fair market value of those items. Donation Value Guide — Value of Goodwill, Inc. items from California, Colorado, Idaho, Iowa, Montana, Nevada, New Hampshire, Oregon, Utah, Washington, and Wisconsin. This list comprises donations that a Salvation Army officer has listed on the online database of donors in his state. The online database is updated regularly. To update your database, you must download and install a free database software, such as the free version of Quicken or Intuit AutoCash. Donating goods to the Salvation Army Thrift Stores | Donation Indexes The Salvation Army Thrift Stores lists each item in the thrift store for sale online at the websites at , and . The Salvation Army also publishes a print edition of the thrift store value guide, printed at 7"x10” paper with a front and back cover. This paper contains a complete listing of every item in every Salvation Army thrift store. The information that is listed in the thrift store value guide is based on all items collected in the thrift stores in 2006. Therefore, some items, such as clothing and equipment, can be valued at less than the information in the document. You can download and print a print copy with a front and back cover (download file is approximately 6.7 MB) by visiting the Salvation Army website and selecting “Search Now.” At the Salvation Army website, select “Order Online.” You should see the “Search Now” button there.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Donation Value Guide Spreadsheet, steer clear of blunders along with furnish it in a timely manner:

How to complete any Donation Value Guide Spreadsheet online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Donation Value Guide Spreadsheet by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Donation Value Guide Spreadsheet from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.