Award-winning PDF software

Goodwill Donation Values 2025 Form: What You Should Know

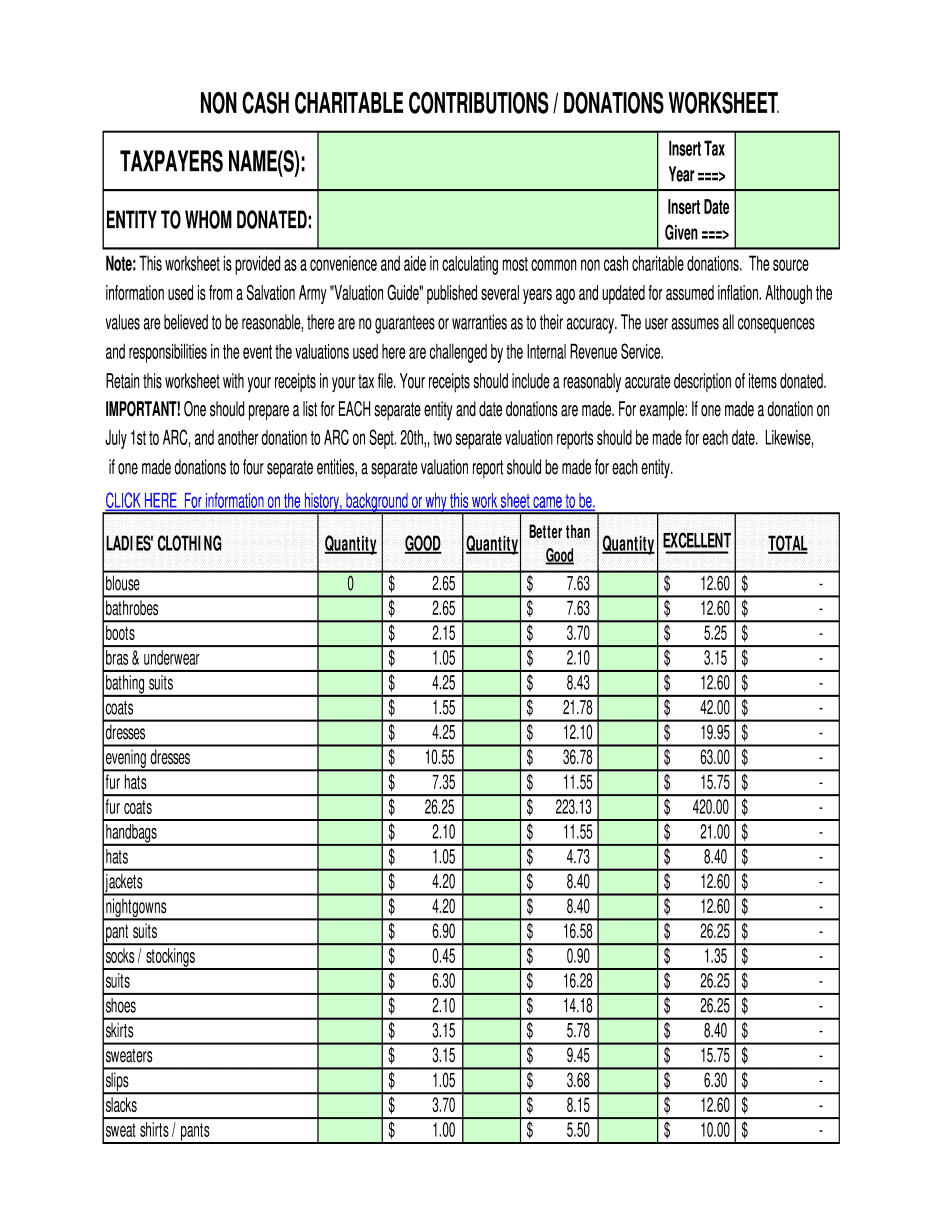

The Salvation Army website. The Salvation Army Charity Guide — Goodwill Industries International Guidebook You can also consult a financial planner, accountant, charity professional, or even a home inspector. All they need is a reasonable estimate of the fair market value. What Should You Do with the Value of Your Donation? When you bring your donated items to Goodwill Industries International, you are encouraged to take them to an experienced Salvation Army worker to review your items to see if the property could be resold. The Salvation Army's Reuse, Recycle, and Redesign (REG) program provides services to customers who wish to recycle items with the charity. For more information visit the Salvation Army Reuse, Recycle, and Redesign (REG) page. You may donate clothing, or other items that fit under the following guidelines. Keep this in mind when choosing your own goodwill donation. Goodwill donation guidelines are often adjusted for inflation. It is important to look at the current sales value. Donations under the guidelines will have a higher resale value than items that are over the guidelines. For Example: If the current sales value of a charity is 500, the item should have a higher resale value than 500. There is no standard resale value for a charity item. If you do not know what the resale value is, you can do the following: Check to see if the charitable item is in stock at other Salvation Army locations, at thrift stores, or the charity's website. If it is, you do not need to appraise it. If the charity has a policy of only rehoming to a customer with their own donation, that can lower the resale value. You should contact the charity with any questions or concerns. When deciding if to donate to any particular charitable organization, you should consider whether your donated items are recyclable. You can recycle your old donation items with the charity, or you may be able to use them to make a variety of new donations. To recycle your donations with a Salvation Army location: Check out the Salvation Army Reuse, Recycle, and Redesign (REG) page and contact the charity. How to Sell Your Goodwill While there are many kinds of goodwill organizations, the Salvation Army offers services and resources to help you sell and donate your donated property.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Donation Value Guide Spreadsheet, steer clear of blunders along with furnish it in a timely manner:

How to complete any Donation Value Guide Spreadsheet online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Donation Value Guide Spreadsheet by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Donation Value Guide Spreadsheet from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.