Award-winning PDF software

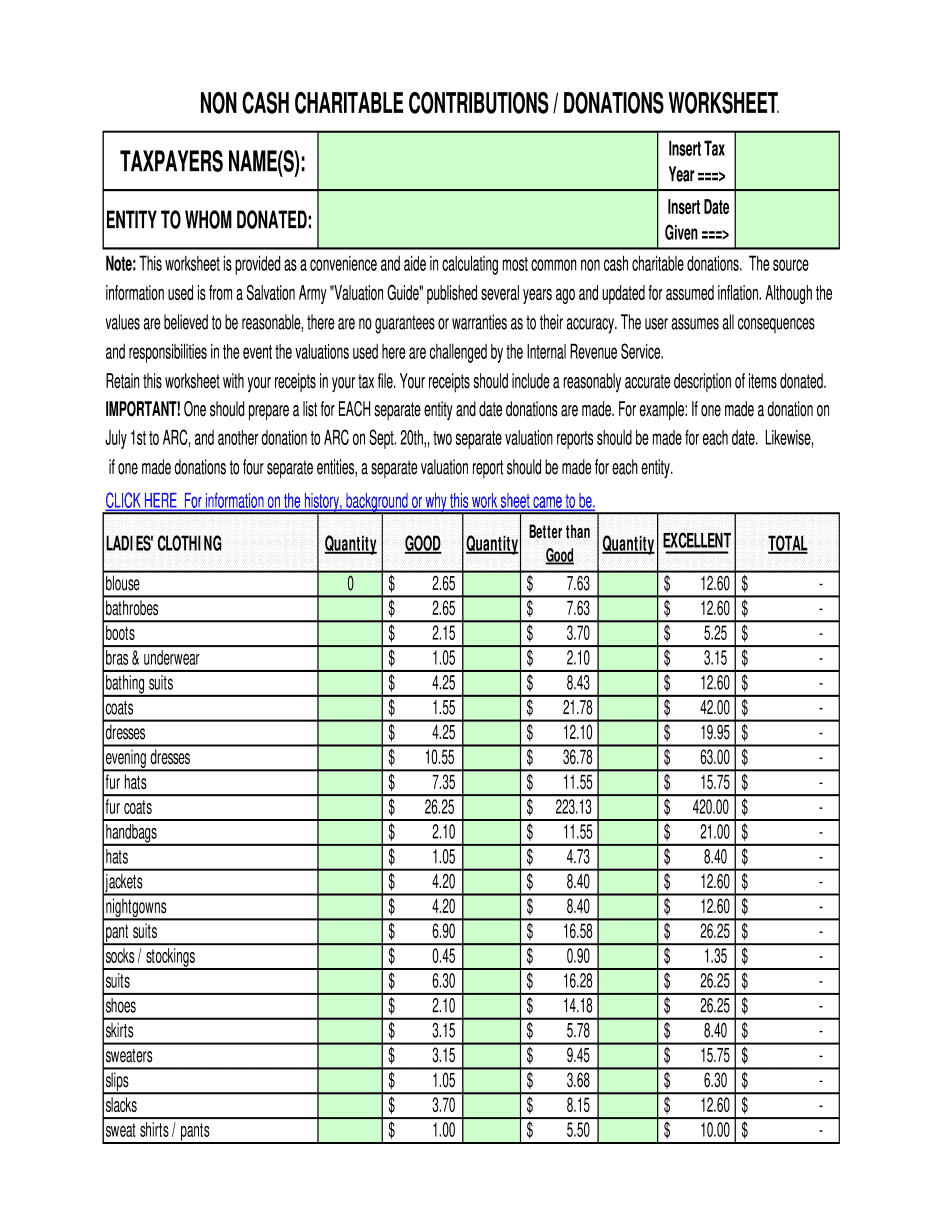

Goodwill donation calculator Form: What You Should Know

Goodwill ONE's IRS Guide — Goodwill ONE's IRS Guide — Goodwill The IRS provides another guideline for donating gently-used items. Donation Value Guide — Goodwill Donations of Computer and Electronic Equipment A Goodwill donation center's equipment is not in working order or is in such great working order that no value is provided for them. Computer Equipment — General Guidelines Goodwill is not responsible for any computer, peripheral, or telecommunications equipment that it receives at its donation centers or from vendors. However, these donations have often not been reviewed for completeness and accuracy and some of it may be obsolete, so Goodwill may accept and use such donations for up to three years. After that, it is at its discretion to determine whether to keep the equipment and whether to refurbish or recycle it. Goodwill is not responsible for damage, loss, or theft of donated computers. If computer equipment is discarded or damaged, or if it is not a good work source, Goodwill must contact you to determine if such problems can be repaired during the three years following the donation date, or, if it is a new computer, you must make an appointment with the center to have the computer evaluated. If equipment must be refurbished or recycled, it will not be accepted through Donations to Goodwill. Goodwill can only accept gently-used computer, peripheral, and telecommunications equipment at the Goodwill one location in Sterling Heights, Michigan. All other locations in the United States accept donated computers. Goodwill CANNOT accept computer and phone equipment that would be accepted from any non-relateable vendor. In this instance, the equipment must have a current manufacturer's identification number or bar code sticker. In addition, Goodwill CANNOT accept any computer or equipment without having a current manufacturer's identification number, bar code, and serial number. The above list of conditions are designed just for gently-used computer, peripherals, and telecommunications equipment. If you have a question about donation acceptability before donating gently-used computer equipment, please contact Goodwill. Goodwill DOES NOT accept computers that have been unregistered or for which a bar code or number is missing. It is important to note that computers and peripherals that were purchased before 1995 DO NOT have bar codes. How to register your charitable donation Goodwill can provide the best value by registering with Donations to Goodwill.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Donation Value Guide Spreadsheet, steer clear of blunders along with furnish it in a timely manner:

How to complete any Donation Value Guide Spreadsheet online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Donation Value Guide Spreadsheet by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Donation Value Guide Spreadsheet from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.