Music, hello and welcome to an investment economy. Today, we are going to discuss Section 8 PG, which gives deductions on your donations. Doing charity is a noble task, not just for God, but the tax department acknowledges this fact as well. Therefore, you get more than just good karma for donating your income to charitable institutions. Section 8 (G) of the Income Tax Act offers a tax deduction on contributions made to certain charitable institutions prescribed under the Income Tax Act. All taxpayers are eligible under this section starting from the financial year 2017-18. Any donations made in cash exceeding rupees 2000 will not be allowed as a deduction. Therefore, the donations exceeding rupees 2000 should be made in any mode other than cash to qualify as a deduction under Section 8. For example, in-kind contributions such as material, clothes, medicine, etc., do not qualify for deduction under this section. To be able to claim this deduction, the following details have to be submitted in your income tax return: name of the donor, PAN of the donor, address of the donor, and the amount of contribution you have made. It is only if the institution where you have donated your money has a stamped receipt that includes the name, address, and PAN of the trust or institution received. The receipt should also include the name of the donor (that is you), details of the amount donated, and the registration number of the trust under Section 8. The validity of registration must be mentioned on the receipt. Now, we should also talk about Form 58. If your donation is eligible for 100% tax deduction, then you also require a Form 58 from the institution where you have donated the money. Details like the cost of the project, amount authorized for the project, and...

Award-winning PDF software

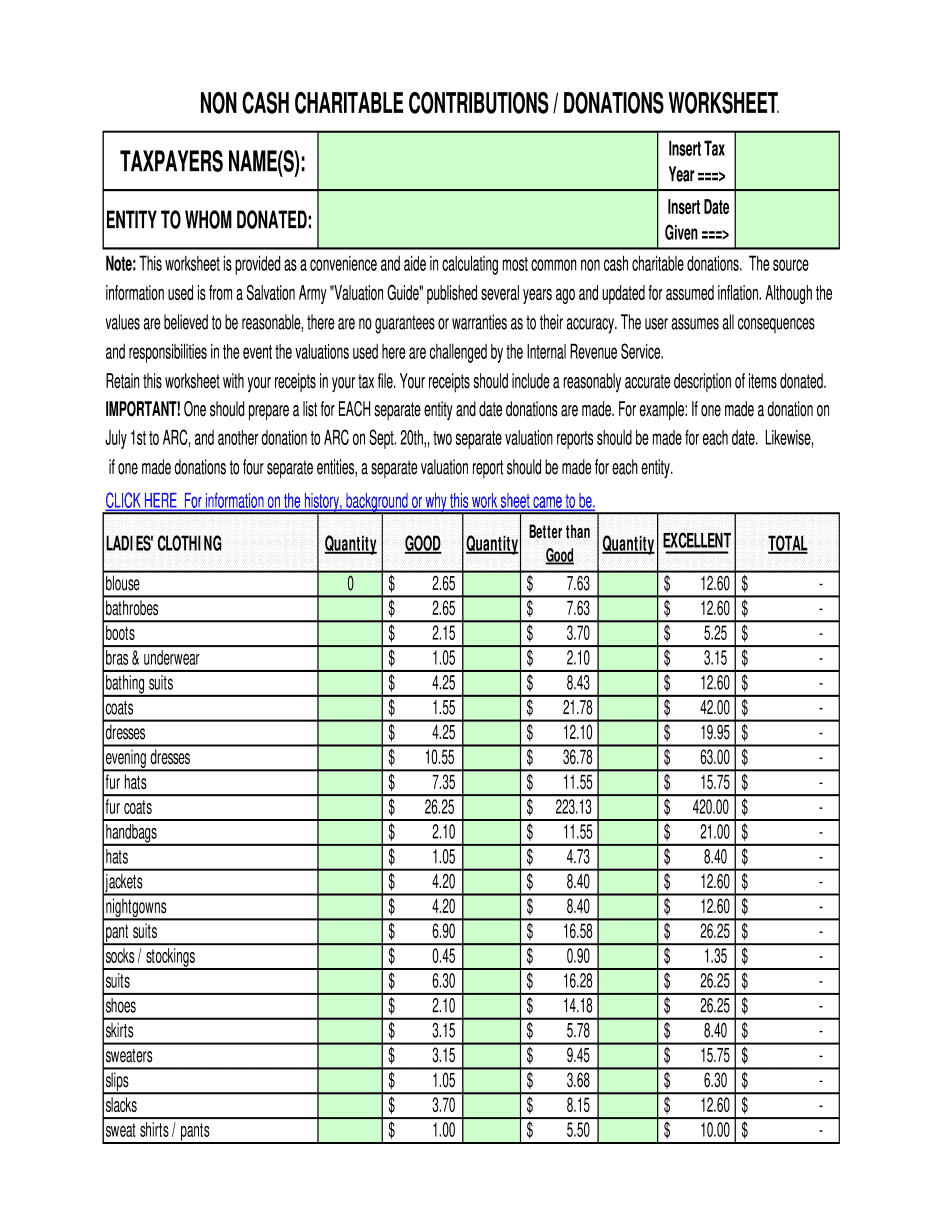

Irs Donation Value Guide 2025 spreadsheet Form: What You Should Know

The value guide worksheet can be used to obtain a value of donated material/property, such as; — Clothes donated — Books donated — Furniture donated — Home Improvements Donation — Tools donated — Computer donated — TV's & Computer donated — Computer/TV / Furniture donated Determining the Value of Gifts of Goodwill Gifts and Gifts in Kind See below article by Dr. William C. Gee, Associate Dean, College of Business and Government, Texas State University, titled “A Method for Valuing Goodwill Property,” which was published in Management Science Vol. 64 No.2, Spring 1985, pp. 464-467 (PDF file) (PDF document). This article describes the value of a product/item, donated to a charity, based upon the values of the various components: the manufacturer, supplier, manufacturer's agent, distributors, and suppliers are valued first and then the product, that is a product of the manufacturer, supplier, distributor, and/or manufacturer's agent is valued. The article is very well researched and presents many helpful guidelines in using the value of various goods and services. However, there are some important tips regarding the calculation of the value of items that were donated: “The most common source of error in using the goodwill estimate comes, not from the donor directly, but from factors such as the length of time that has gone by since the donation or the number of occasions the good will be in the same place several days apart. The longer the time that has passed by, the greater the risk of a measurement error in the price, because the value of the good is lessening over time. This is especially serious for the last category of donated items in which it pays to be sure that the goods arrive in adequate condition before placing a value on them. This last category is those items that are in such relatively good condition that even in a relatively small place such as the Salvation Army furnishings will be well-preserved and not need to be put through the painstaking process of being stored before their value is assessed.” — Dr. William C. Gee, Associate Dean, College of Business and Government, Texas State University, Valuing Goodwill and Donations and The Value of Goodwill Items in the Business Environment by Dr. C.C. Deal, (Request Dissertations and Seminars Series. 2013).

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Donation Value Guide Spreadsheet, steer clear of blunders along with furnish it in a timely manner:

How to complete any Donation Value Guide Spreadsheet online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Donation Value Guide Spreadsheet by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Donation Value Guide Spreadsheet from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs Donation Value Guide 2025 spreadsheet