I just cleaned out my closet this weekend because I couldn't really fit anything else in there I'm sure you've probably done the same thing and wondered what to do with the clothing you don't wear anymore my favorite thing is to take it down to the corner to the closest charity near my house which is the goodwill this is the kind of receipt that they'll give you and it asks for a couple of things typically the value of the clothing that you have in your closet is not anywhere near what you actually paid for it so you'll need to give a donor's estimate of value and put that on the receipt so that's what we have here you'll also need to report on your tax return the amount is you actually paid for the item if it's be above a certain threshold the place to report the donation value is actually on Schedule A a form 1040 right here under gifts to charity other than cash so you just have to keep track of these items and you should keep receipts to back up this this information and then you can clean out your closet and make room for more shoes I'm Kristen brand and that is how you deduct clothing given away to charity.

Award-winning PDF software

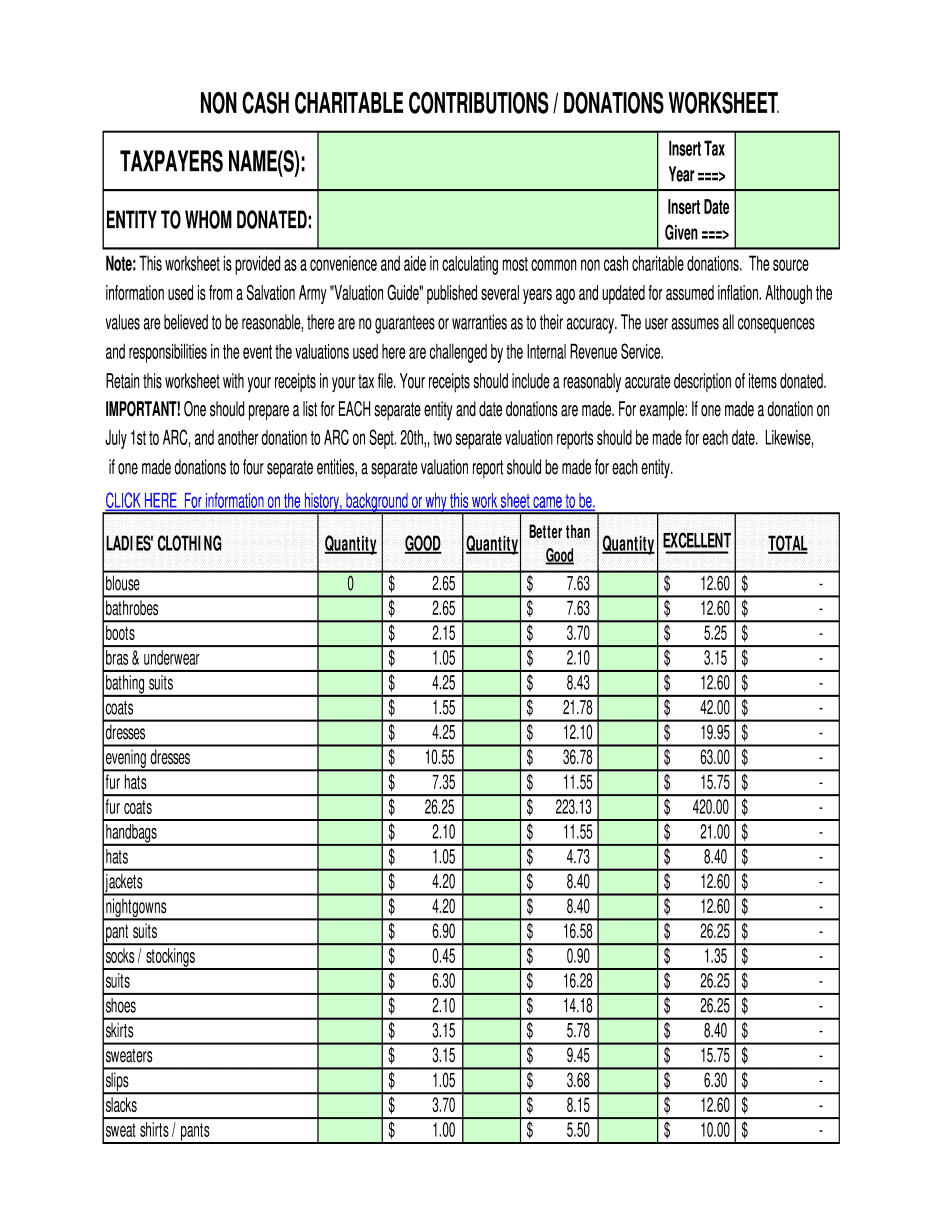

When to file Donation Value Guide Spreadsheet Form: What You Should Know

The “Calendar Year Taxable Value” Worksheet This worksheet contains a “Year-End Taxable Value” of your property and the percentage of the taxable value. This worksheet contains a “Year-End Taxable Value” of your property and the percentage of the taxable value. The “Calendar Year Taxable Value” Worksheet Get tax-refund calculation Publication 551 (03/2122), Determining the Value of Donated May 6, 2025 — This publication will help you determine the value of your noncash contributions to a qualified organization. Form 8453 — Qualified Organization Contributions — IRA or 401(k) This worksheet provides the information needed to use the IRS Form 1098-INT to calculate the IRA or 401(k) limits on your taxable IRA earnings. The Tax-Free Period Worksheet This worksheet contains data regarding your taxable deductible IRA contributions to your company. The table is updated daily. You are welcome to modify the information in this worksheet as you wish. Worksheets for the 2025 Federal Income Tax Return All Tax Returns 2018 Form 8443-A, Return of Qualified Real Property This form was used by the IRS and some states (California, Idaho, Kentucky, Missouri, Nebraska, and Vermont) to process real, personal property as an investment. You will most often want to contact your state or local tax office to determine how these state tax forms are being used and what you can do to correct the situation. This form was used by the IRS and some states (California, Idaho, Kentucky, Missouri, Nebraska, and Vermont) to process real, personal property as an investment. You will most often want to contact your state or local tax office to determine how these state tax forms are being used and what you can do to correct the situation. Currency Value Worksheet for the 2025 Federal Income Tax Return This worksheet contains data regarding the conversion of foreign currency (US dollars or Australian dollars) to US dollars or Australian dollars to US dollars.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Donation Value Guide Spreadsheet, steer clear of blunders along with furnish it in a timely manner:

How to complete any Donation Value Guide Spreadsheet online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Donation Value Guide Spreadsheet by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Donation Value Guide Spreadsheet from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing When to file Donation Value Guide Spreadsheet