How do I itemize a donation to Goodwill? This is a very good question. Most of you probably know that the charitable contributions you make go on your Schedule A, which is itemized deductions. It is kind of right there in the middle of the form. - Let's go over it. If you give cash, it's on one line of the form. But if you give non-cash items like furniture, old clothing, or kids toys to Goodwill, for example, that is also included on Schedule A. - However, if you have more than $500 of non-cash contributions, you have to attach another form. Who would have thought that the IRS would want us to attach another form? Well, we all thought that, in fact. The form you actually need is Form 8283. The title of the form is "Non-Cash Charitable Contributions." - You need this form if your total contributions to the Salvation Army, Goodwill, your church, or any other organization add up to $500 or more. It's relatively easy to complete. You just need to provide the name of the organization you donated to, a description of the property, and its value. - Keep in mind that most non-cash items are assumed to be donated at thrift store values. So, be careful when assigning a value to an item. For example, if you donated a suit that you bought for $200 five years ago when you were heavier, it will not be worth $200 now. - Using Form 8283, you can see that it's relatively easy to fill out. If you end up with more than $500 in contributions, attach this form to your tax return. The total from this form goes on Schedule A, and you will be rewarded with a deduction for your charitable giving. - Remember,...

Award-winning PDF software

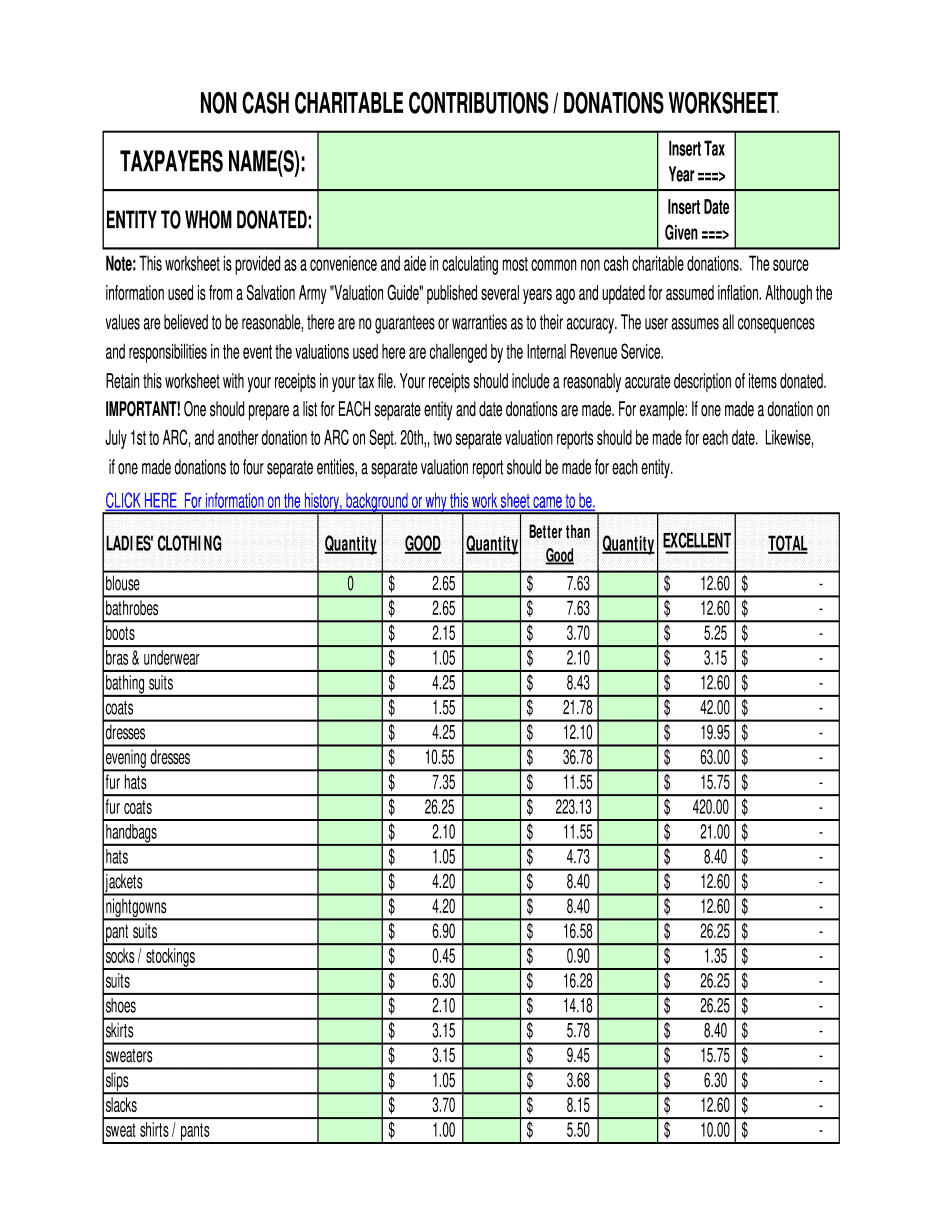

What is Donation Value Guide Spreadsheet Form: What You Should Know

The values on this list are for those items which could be reasonably expected to be used as a component of Goodwill Industries International property, including the warehouse and office space. Goodwill International Valuation Guide 2017 The value on this guide is based on valuation ranges provided by the Goodwill Industries International, and is intended to be used as a guide for determining the tax-deductible value of a good will donation. It does not include any special items to be added to Goodwill's appraisal list, i.e., Property used as a component of Goodwill Industries International's inventory (e.g., warehouse space, equipment, fixtures) Property used as a component of Goodwill's storage and distribution areas (e.g., trailers, warehouse structures) Goodwill also provides an on-line Goodwill Valuation Guide. Goodwill Valuation Guide 2016 The Goodwill Valuation Guide 2025 is based on valuation ranges, and is intended to be used as a guide for determining the tax-deductible value of a good will donation. It does not include any special items to be added to Goodwill's appraisal list, i.e., Property used as a component of Goodwill's inventory (e.g., warehouse space, equipment, fixtures) Property used as a component of Goodwill's storage and distribution areas (e.g., trailers, warehouse structures) Goodwill also provides an on-line Goodwill Valuation Guide. Goodwill Valuation Guide 2014 The Goodwill Valuation Guide 2025 is based on valuation ranges, and is intended to be used as a guide for determining the tax-deductible value of a good will donation. It does not include any special items to be added to Goodwill's appraisal list, i.e., Property used as a component of Goodwill's inventory (e.g., warehouse space, equipment, fixtures) Property used as a component of Goodwill's storage and distribution areas (e.g., trailers, warehouse structures) Goodwill also provides an on-line Goodwill Valuation Guide. Goodwill Valuation Guide 2013 The Goodwill Valuation Guide 2025 is based on valuation ranges, and is intended to be used as a guide for determining the tax-deductible value of a good will donation. It does the Not include any special item to be added to this list.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Donation Value Guide Spreadsheet, steer clear of blunders along with furnish it in a timely manner:

How to complete any Donation Value Guide Spreadsheet online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Donation Value Guide Spreadsheet by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Donation Value Guide Spreadsheet from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing What is Donation Value Guide Spreadsheet